Professional Credit Repair Experts

Trusted Solutions to Improve Your Credit Score

Our experienced credit specialists help you take control of your financial future with proven strategies to restore credit, raise scores, and secure approvals. We provide reliable credit restoration services backed by expertise, integrity, and results.

Your Trusted Partner in Credit Restoration

Credit restoration rooted in discipline, transparency, and federal consumer protection laws. Each strategy is built to remove damaging inaccuracies, strengthen your profile, and unlock lasting financial opportunity.

Legal Guidance

Strategies grounded in consumer protection laws ensure disputes are handled with precision. Every action is designed to safeguard your rights and restore credit health.

Clear Process

A structured and transparent approach that keeps you informed at every stage. Progress is easy to follow, ensuring clarity and confidence from start to finish.

Proven Results

Reliable improvements that restore access to financial opportunities. Clients consistently achieve stronger scores and renewed confidence in their credit health.

Ready to get started?

Rebuilding Your Financial Future

Our team applies a disciplined, law-based approach to identify and dispute inaccurate or unverifiable information across your credit profile. Each dispute is handled with precision, leveraging federal consumer protection laws to restore accuracy and strengthen your financial standing.

Delinquency Records

Incorrectly reported late or missed payments can significantly reduce creditworthiness. Each account is reviewed in detail, and any record that cannot be verified or is reported inaccurately is formally disputed for removal.

Charge-Offs & Collections

Accounts listed as charged-off or sent to collections often remain even after being paid or resolved. These items are carefully examined for compliance with reporting laws, and disputes are filed where errors or outdated information are identified.

Public Records & Legal Items

Bankruptcy filings, civil judgments, or tax liens may be reported inaccurately or beyond the legal reporting period. These entries are validated against compliance standards, with disputes initiated to correct or remove improper records.

Hard Inquiries

Unverified or unauthorized credit inquiries can create unnecessary score reductions. Each inquiry is reviewed for proper authorization, and non-compliant entries are formally challenged under federal guidelines.

Account Reporting Errors

Duplicate accounts, incorrect balances, and outdated creditor information often distort a credit profile. Discrepancies are investigated, documented, and disputed to ensure accurate reporting across all three bureaus.

Identity & Fraudulent Activity

Fraudulent accounts or transactions can have lasting financial consequences if left unchallenged. Using consumer protection laws, disputes are filed to remove illegitimate accounts and restore the integrity of the credit profile.

Every dispute is prepared and executed with a compliance-first approach, ensuring your rights as a consumer are upheld and that your credit profile reflects only verified, accurate information.

Our Mission

At Elevated Freedom Solutions, we believe that everyone deserves a second chance to achieve their financial goals. Founded on the principles of integrity, transparency, and results-driven service, we specialize in helping individuals and families rebuild their credit and unlock the financial opportunities they deserve.

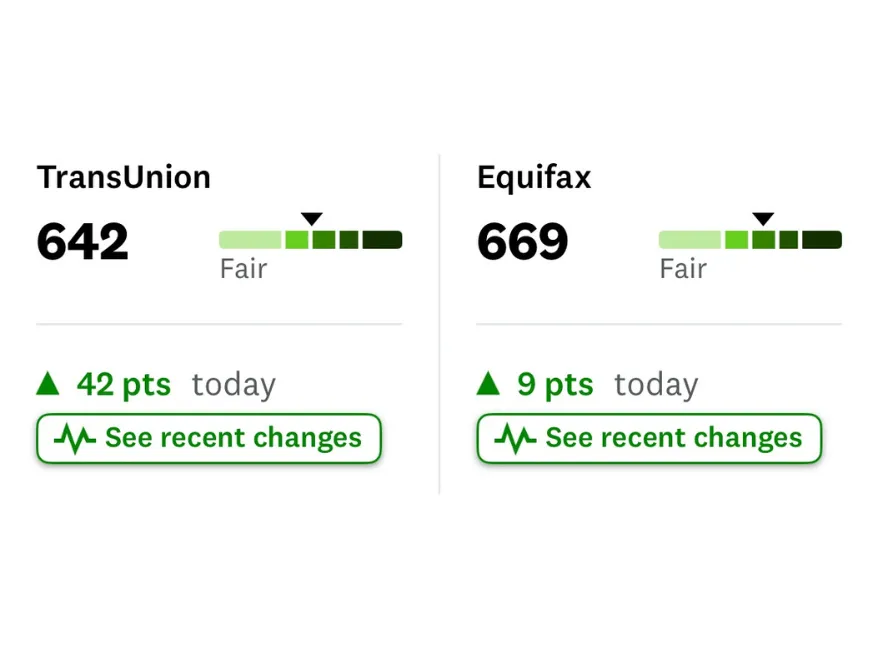

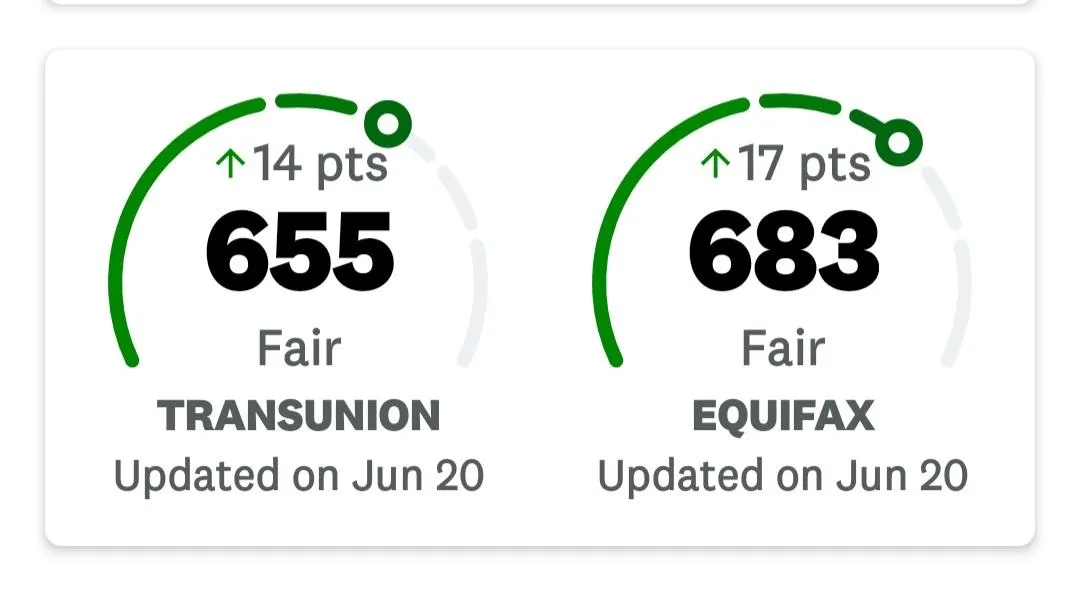

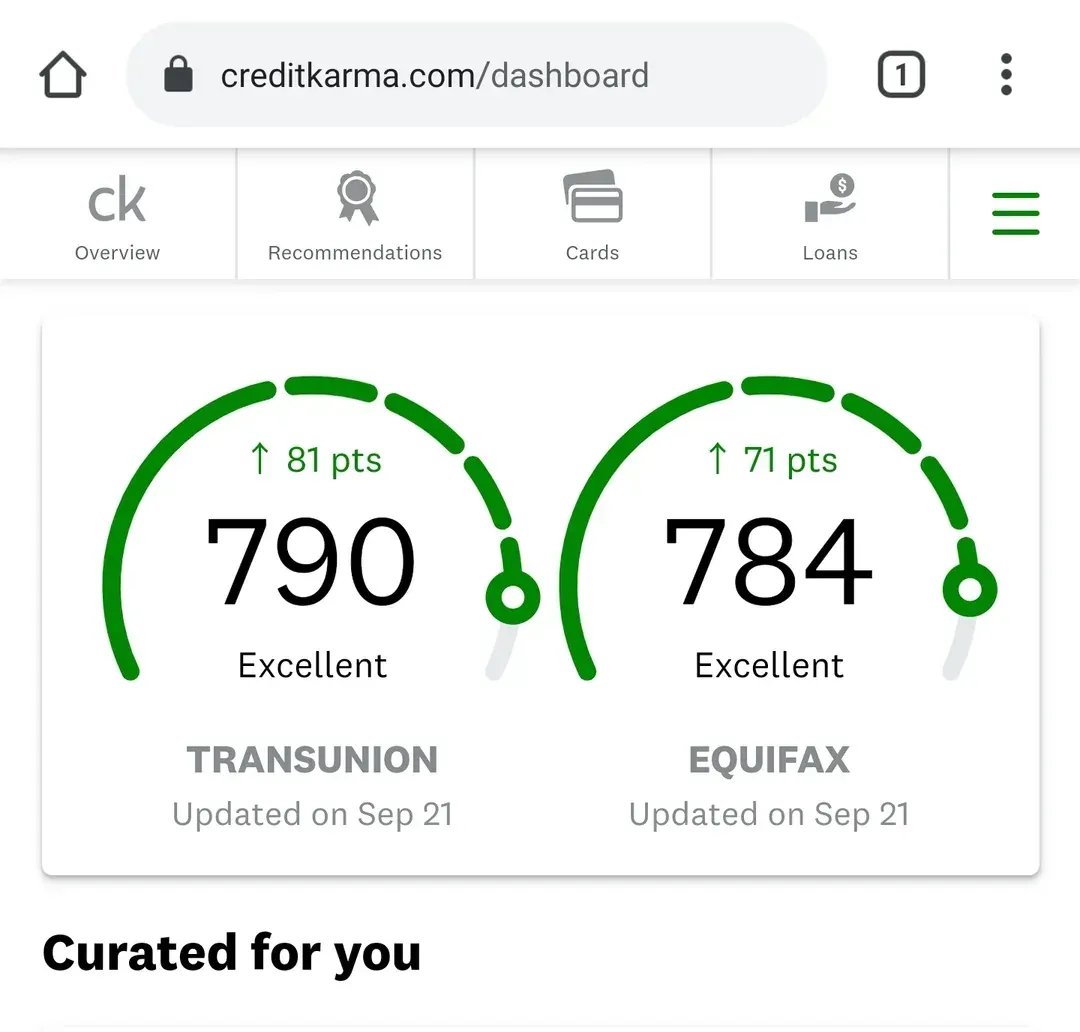

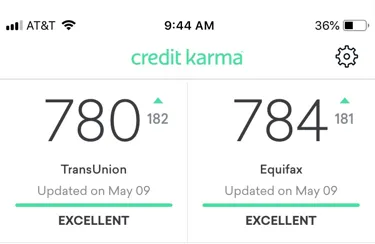

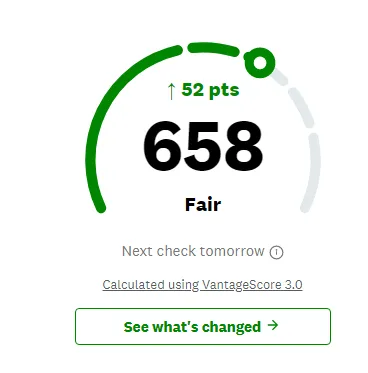

Proven Results Backed by Real Clients

See the actual credit score improvements our clients have achieved with our proven strategies.

Shannon D.

Before: 494

After: 712

in 6 months

"My credit score improved faster than I expected. The process was transparent, and every dispute was handled with precision and care."

Andrew S.

Before: 523

After: 692

in 4 months

"Late payments and errors were removed quickly, and I finally qualified for the approval I had been denied for years."

Marcus C.

Before: 576

After: 751

in 5 months

"The team restored my credit with discipline and clarity, turning a stressful situation into a confident financial future."

Ready to see similar results?

Our Pricing

Simple, Straightforward Pricing You Can Trust.

Standard Plan

Our comprehensive credit repair service includes:

Comprehensive Credit Report & Analysis

Dispute Resolution with All Three Major Credit Bureaus

Creditor Communication & Advocacy

Ongoing Progress Reporting

Customized Long-Term Credit Improvement Plan

$99/Month

Disclaimer: The customer is responsible for maintaining an active account with the advised credit monitoring service throughout the duration of the credit repair service. Please note that software fees may apply.

Accelerated Plan

Accelerated Credit Solutions with Personalized Guidance

Comprehensive Credit Report Analysis

Tailored Dispute Strategies Using Consumer Protection Laws

Certified Mail Management & Communication

Secure 24/7 Client Portal Access

Dedicated Team Support

$1500 One Time

Disclaimer: The customer is responsible for maintaining an active account with the advised credit monitoring service throughout the duration of the credit repair service. Please note that software fees may apply.

Frequently Asked Questions

Everything You Need to Know About Credit Repair

What is credit repair?

Credit repair is the process of identifying and challenging inaccurate, outdated, or unverifiable information on your credit reports. The goal is to ensure your reports reflect fair and accurate information so that your credit score can improve.

How does your credit repair service work?

We carefully review your credit reports, identify questionable items, and send disputes directly to the credit bureaus and creditors on your behalf. Throughout the process, we also guide you on positive credit habits to help you build lasting results.

Is credit repair legal?

Yes, credit repair is completely legal. Under the Fair Credit Reporting Act and the Credit Repair Organizations Act, you have the legal right to dispute any inaccurate or unverifiable information on your credit report.

How long does credit repair take?

Every credit situation is different, but most clients begin to see results within 30 to 90 days. Depending on the complexity of your case, the full process can take several months to a year.

What types of items can you remove?

We work to dispute a wide range of negative items, including late payments, collections, charge-offs, bankruptcies, repossessions, foreclosures, and even hard inquiries when they are inaccurate or unverifiable.

Will credit repair completely fix my credit?

Credit repair is not a quick fix or a magic solution. While removing negative items can improve your score, true credit health also depends on positive financial behavior such as paying bills on time and keeping your credit utilization low. We will coach you on how to build and maintain healthy credit habits.

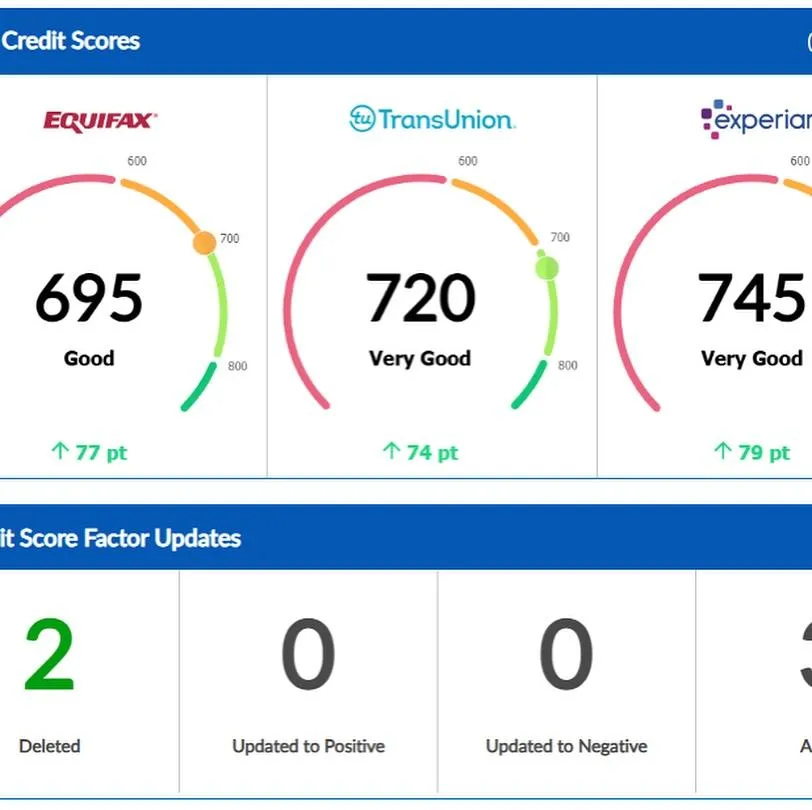

Do you work with all three credit bureaus?

Yes. We address items with Equifax, Experian, and TransUnion to ensure your reports are consistent across all three. Many lenders pull from different bureaus, so correcting just one report is not enough. Our process targets all three simultaneously.

What laws protect me during this process?

Your rights are backed by the Fair Credit Reporting Act (FCRA), the Fair Debt Collection Practices Act (FDCPA), and the Credit Repair Organizations Act (CROA). These laws require that every account reported to the credit bureaus be accurate, complete, and verifiable. If a company fails to meet these standards, the item must be corrected or removed.

We’ve Got You Covered

We believe in transparency and trust. That’s why every plan at Elevated Freedom Solutions includes a 90-day satisfaction guarantee—so you can focus on your goals, worry-free.*

*While we work hard to deliver results, no credit repair company can legally promise a specific outcome or credit score increase.